By using a smart AI app, you can get a better grip of your finances and set more aside.ĭownload Plum for free here on Apple and Andriod devices. It takes all the pressure off you having to do anything. It analyses your spending patterns and automatically puts your money away for you, so you don’t have to think about it. It’s the smartest app for managing your money.

Plum – Plum is a free app that helps boosts your bank balance*. If you do prefer electric saving planners then have a look at: Having the whole family involved can really help get them all on board with your money-saving. This could be on the fridge or in the living room somewhere. Put it somewhere that your whole family can see it. Then you need to decide how much from your wages you can use for each of your categories. This could be petrol, Christmas saving, clothes, food, hobbies etc.

Once you’ve done that, you need to scan through and decide what your categories will be. To do that, you need to work out how much you spend on and on what. The aim is to have your books balancing – so you’re not spending more than you earn. Then divide it by three to come up with your outgoings. Look through your shopping bill, your last energy bill, annual bills and anything else you spend your money on. Our top budget planning tips for families who are just starting to manage their money are: Look at the last three months Being overdrawn is definitely a good indicator that it isn’t. Never think that having cash in your bank account means your budget is balanced. It misses out what payments are due in or out, when direct debits are paid, and when you need to go shopping. Your bank account lies! When you check it, it only shows you a simple snapshot of the scene that day. Yet before you can solve any issues it’s important to get an accurate idea of the size and scale of the problem.īefore you start using a budget planner remember that: Major overspending can lead to a debt spiral and severe problems, that’s why using a budget planner every month is a good idea and can answer these questions quickly for you. Do you have any money left over at the end of the month? Are you eating up your savings or building up debts? The first thing to work out is, do you spend more than you earn? You should also remember to account for annual costs, such as Christmas, birthday presents, car costs, etc.Ĭreating your budget will give you a clear starting point, so that you know where your finances stand before you decide to either start cutting back or make more money. Having a budget means knowing exactly what you’re spending compared to your incomings. Knowing your income and outgoings is the first step you need to take when you are trying to take back control of your finances.ĭespite the name, creating a budget doesn’t mean you have to be frugal or only spend the same amount every week. If you are new to budgeting, then it can be hard to know where to start.

#Savings planner printable how to#

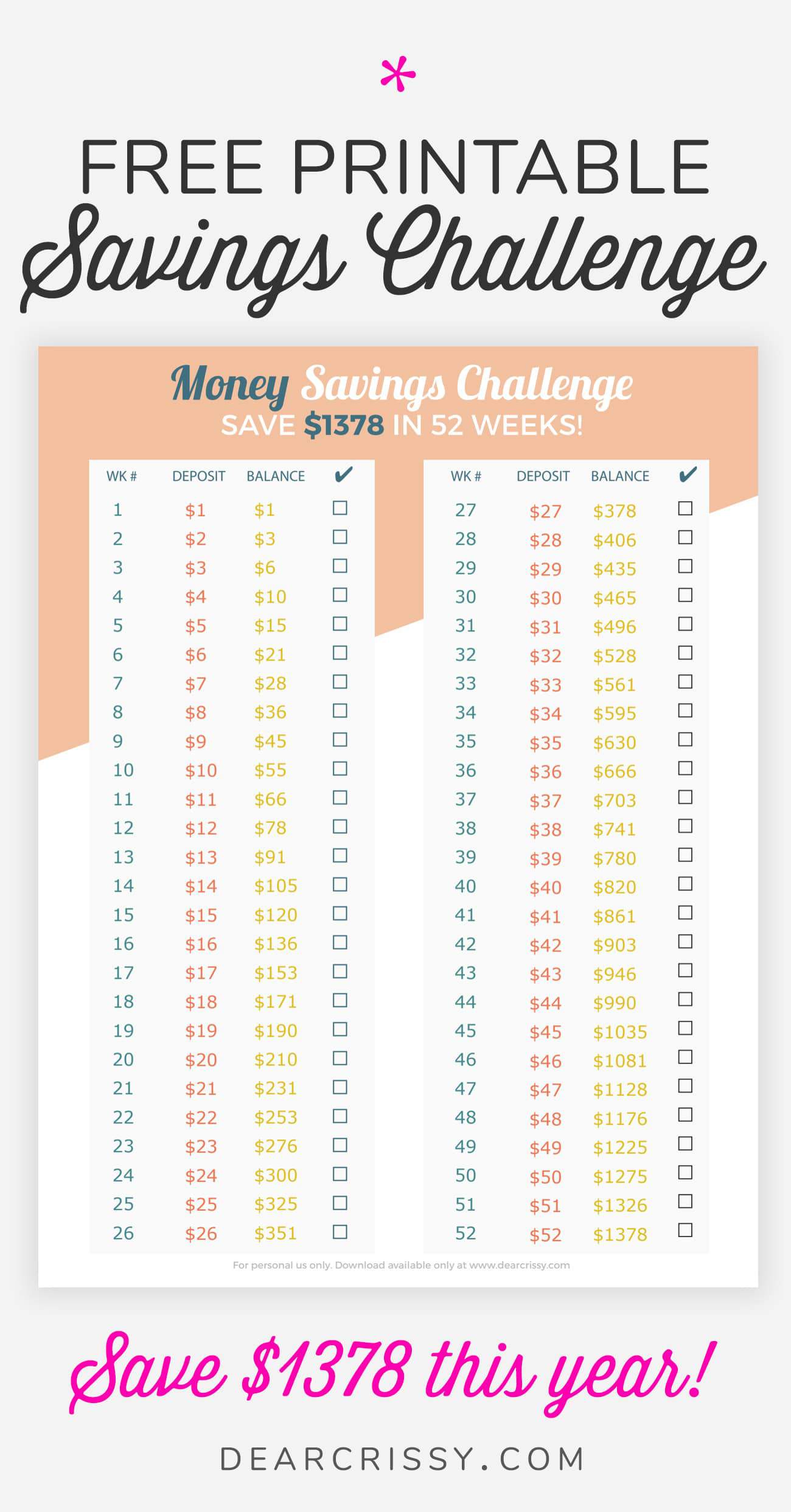

How to make sure that you stick to your budget These are all perfect if you like to have a physical copy of your budget up, front and center. We’ve pulled together as many creative and free printable budget planners that you can use to help you keep your money on track. All of these budget planners can help you save money and budget right. If you are looking for free printable budget planners that can help you to save money as a family then this post is for you.

0 kommentar(er)

0 kommentar(er)